What is a Pip in Forex

Introduction

Forex trading, also known as foreign exchange trading, involves the exchange of currencies on a global market. It is one of the largest and most liquid markets in the world, with trillions of dollars traded daily. For anyone stepping into the world of Forex trading, understanding key concepts is crucial for success. One of the most fundamental concepts is the “pip.”

A pip in Forex is a standard unit of measurement for price movements and is essential for calculating profits and losses. This comprehensive guide will help you understand what a pip is, how it is calculated, its importance in trading, and much more. Whether you are a beginner or looking to refine your trading knowledge, this guide will provide valuable insights.

What is a Pip in Forex?

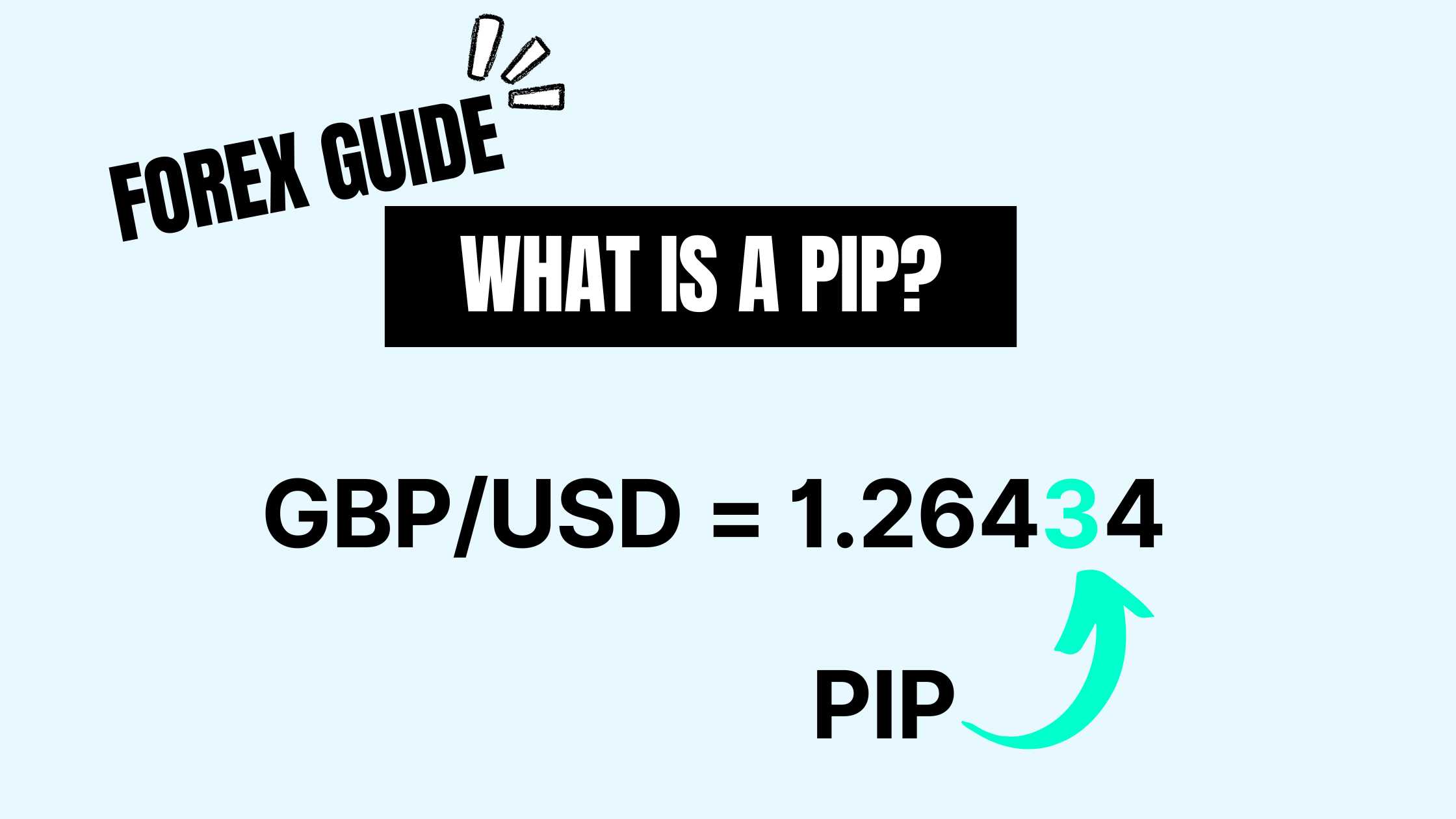

Definition of a Pip

A pip, short for “percentage in point” or “price interest point,” is a unit of measurement used in Forex trading to express the change in value between two currencies. It is typically the smallest price move that a given exchange rate can make based on market convention. For most currency pairs, a pip is equal to 0.0001, which is one-hundredth of a percent. However, for currency pairs involving the Japanese yen (JPY), a pip is 0.01.

Historical Context and Origin:

The term “pip” originated from the need to measure the smallest changes in currency values, especially when dealing with very large numbers. Over time, it became a standardized measure in Forex trading, helping traders quickly understand and communicate price changes.

Standardized Measure in Forex Trading:

A pip is the fourth decimal place in most currency pairs. For example, if the EUR/USD moves from 1.1050 to 1.1051, it has moved one pip. For pairs involving the JPY, such as USD/JPY, a pip is the second decimal place. If USD/JPY moves from 110.10 to 110.11, it has moved one pip.

How Pips are Calculated

Calculating pips in Forex trading depends on the currency pairs involved. Here are the methods for different types of currency pairs:

Major Currency Pairs:

For most major currency pairs, a pip is calculated to the fourth decimal place. For example, in the EUR/USD pair:

- Example: If EUR/USD moves from 1.1050 to 1.1051, the movement is 1 pip.

Currency Pairs Involving JPY:

For pairs involving the Japanese yen, a pip is calculated to the second decimal place. For example, in the USD/JPY pair:

- Example: If USD/JPY moves from 110.10 to 110.11, the movement is 1 pip.

Exotic Currency Pairs:

Exotic pairs may have different pip values based on their liquidity and volatility. However, the calculation principle remains the same:

- Example: If USD/TRY moves from 7.8500 to 7.8550, the movement is 50 pips.

Here is a table summarizing pip calculations for different types of currency pairs:

| Currency Pair | Initial Price | New Price | Pip Movement |

|---|---|---|---|

| EUR/USD | 1.1050 | 1.1051 | 1 pip |

| USD/JPY | 110.10 | 110.11 | 1 pip |

| GBP/USD | 1.3100 | 1.3110 | 10 pips |

| USD/TRY | 7.8500 | 7.8550 | 50 pips |

Understanding how pips are calculated is essential for accurate trading and analysis. It allows traders to measure price movements precisely and make informed trading decisions.

Importance of Pips in Forex Trading

Role of Pips in Measuring Price Movements

Pips play a crucial role in Forex trading as they represent the smallest unit of price movement. Understanding pips is essential for analyzing market trends and making informed trading decisions. Every price change in the Forex market is measured in pips, making it the universal language for traders worldwide.

How Pips Indicate Price Changes:

Pips provide a standardized way to express and compare price movements across different currency pairs. For example, saying that a currency pair moved 100 pips is more precise and universally understood than saying it moved 0.0100.

Impact of Pip Changes on Trading Decisions:

Traders use pip movements to gauge the market’s volatility and potential profit or loss from trades. For instance, a higher pip movement in a short period indicates higher volatility, which could present both opportunities and risks.

Real-World Examples:

- Example 1: If the EUR/USD pair moves from 1.1000 to 1.1050, it indicates a 50-pip movement. A trader who bought at 1.1000 and sold at 1.1050 would have gained 50 pips.

- Example 2: If the USD/JPY pair moves from 110.00 to 110.50, it indicates a 50-pip movement. A trader shorting this pair would have lost 50 pips if they sold at 110.00 and bought back at 110.50.

Pips and Profit/Loss Calculation

Understanding pips is vital for calculating profits and losses in Forex trading. Each pip’s value is determined by the currency pair being traded, the trade size, and the account currency.

How Pips are Used to Calculate Profits and Losses:

- Determine the Pip Value: The pip value is the monetary worth of a single pip movement. For most major currency pairs, a standard lot (100,000 units) has a pip value of $10.

- Calculate Profit/Loss: Multiply the number of pips gained or lost by the pip value and the trade size.

Examples of Profit/Loss Calculations:

- Example 1: A trader buys 1 standard lot of EUR/USD at 1.1000 and sells at 1.1050. The pip movement is 50 pips. The profit is 50 pips * $10 = $500.

- Example 2: A trader sells 1 mini lot (10,000 units) of GBP/USD at 1.3100 and buys back at 1.3150. The pip movement is -50 pips. The loss is 50 pips * $1 = $50.

Role of Pip Value in Different Account Currencies:

The value of a pip can vary depending on the account currency. For example, if an account is denominated in euros, the pip value will be different compared to an account denominated in US dollars.

Here is a table summarizing pip value calculations for different scenarios:

| Currency Pair | Lot Size | Pip Movement | Pip Value (USD Account) | Profit/Loss |

|---|---|---|---|---|

| EUR/USD | Standard | 50 pips | $10 per pip | $500 |

| GBP/USD | Mini | -50 pips | $1 per pip | -$50 |

| USD/JPY | Standard | 30 pips | $9.13 per pip | $273.90 |

Understanding the importance of pips in calculating profits and losses helps traders manage their risk and develop effective trading strategies.

Pip Value and Its Calculation

Understanding Pip Value

The pip value is the monetary worth of each pip movement and varies depending on the currency pair, trade size, and account currency. Knowing the pip value is crucial for accurate profit and loss calculations.

Factors Influencing Pip Value:

- Currency Pair: Different pairs have different pip values due to their exchange rates.

- Lot Size: The trade size (standard, mini, micro) affects the pip value. A standard lot is 100,000 units, a mini lot is 10,000 units, and a micro lot is 1,000 units.

- Account Currency: The currency in which your account is denominated also influences pip value.

Pip Value Calculation Formula:

For currency pairs where the USD is the quote currency (e.g., EUR/USD, GBP/USD):

Pip Value=0.0001Exchange Rate×Lot Sizetext{Pip Value} = frac{0.0001}{text{Exchange Rate}} times text{Lot Size}Pip Value=Exchange Rate0.0001×Lot Size

For currency pairs where the USD is not the quote currency (e.g., USD/JPY):

Pip Value=0.01Exchange Rate×Lot Sizetext{Pip Value} = frac{0.01}{text{Exchange Rate}} times text{Lot Size}Pip Value=Exchange Rate0.01×Lot Size

Pip Value Calculation Examples

Example 1: Calculating Pip Value for EUR/USD

- Exchange Rate: 1.1050

- Lot Size: Standard (100,000 units)

- Pip Value: 0.00011.1050×100,000=$9.05frac{0.0001}{1.1050} times 100,000 = $9.051.10500.0001×100,000=$9.05

Example 2: Calculating Pip Value for USD/JPY

- Exchange Rate: 110.50

- Lot Size: Standard (100,000 units)

- Pip Value: 0.01110.50×100,000=$9.05frac{0.01}{110.50} times 100,000 = $9.05110.500.01×100,000=$9.05

Example 3: Calculating Pip Value for GBP/USD in a Mini Lot

- Exchange Rate: 1.3100

- Lot Size: Mini (10,000 units)

- Pip Value: 0.00011.3100×10,000=$0.76frac{0.0001}{1.3100} times 10,000 = $0.761.31000.0001×10,000=$0.76

Here is a table summarizing these examples:

| Currency Pair | Lot Size | Exchange Rate | Pip Value |

|---|---|---|---|

| EUR/USD | Standard | 1.1050 | $9.05 |

| USD/JPY | Standard | 110.50 | $9.05 |

| GBP/USD | Mini | 1.3100 | $0.76 |

Understanding how to calculate pip value is essential for managing risk and planning trades effectively.

Tools and Platforms for Pip Calculation

Trading Platforms with Built-in Pip Calculators

Many modern trading platforms come equipped with built-in pip calculators, making it easier for traders to calculate pip values, profits, and losses quickly and accurately. Here are some of the most popular trading platforms with these features:

MetaTrader 4 (MT4):

- Features: MT4 is renowned for its user-friendly interface, advanced charting tools, and a wide range of technical indicators. It also includes a built-in pip calculator that helps traders determine pip values effortlessly.

- How to Use: To use the pip calculator in MT4, simply open the “Market Watch” window, select the desired currency pair, and access the “Specification” tab. Here, you can find detailed information about the pip value for that pair.

MetaTrader 5 (MT5):

- Features: MT5 offers all the functionalities of MT4, along with additional tools for more advanced trading. It includes an economic calendar, more timeframes, and a comprehensive pip calculator.

- How to Use: Similar to MT4, navigate to the “Market Watch” window, select the currency pair, and check the “Specification” tab for pip value information.

cTrader:

- Features: cTrader is known for its intuitive interface, detailed charting options, and fast execution speeds. It provides a built-in pip calculator that is easily accessible.

- How to Use: Open cTrader, select the currency pair you are interested in, and look for the pip value details in the “Market Watch” section.

Features of Built-in Pip Calculators:

- Real-time Data: These calculators use real-time market data to provide accurate pip values.

- User-friendly Interface: Easy to navigate and use, even for beginners.

- Comprehensive Information: Includes details about lot sizes, leverage, and other relevant factors affecting pip values.

Online Pip Calculators

In addition to trading platforms, numerous online tools are available to help traders calculate pip values. These calculators are particularly useful for quick calculations and can be accessed from any device with an internet connection.

Benefits of Using Online Pip Calculators:

- Accessibility: Available anytime, anywhere.

- Ease of Use: Simple interfaces that require minimal input.

- Accuracy: Provides precise calculations based on current exchange rates.

Recommended Websites and Tools:

- BabyPips Pip Calculator: A widely used tool that offers accurate pip value calculations for various currency pairs and account currencies. Visit BabyPips Pip Calculator

- Forex.com Pip Calculator: Another reliable tool from a leading Forex broker. Visit Forex.com Pip Calculator

- Investing.com Pip Calculator: Provides a quick and easy way to calculate pip values. Visit Investing.com Pip Calculator

Step-by-Step Guide to Using an Online Pip Calculator:

- Enter Currency Pair: Select the currency pair you want to calculate the pip value for.

- Input Trade Size: Enter the size of your trade (standard, mini, or micro lot).

- Specify Account Currency: Choose the currency your trading account is denominated in.

- Calculate: Click the calculate button to get the pip value.

Example Using BabyPips Pip Calculator:

- Currency Pair: EUR/USD

- Trade Size: 100,000 units (standard lot)

- Account Currency: USD

- Result: The pip value is $10.

Using these tools and platforms can significantly streamline the process of calculating pip values, helping traders make more informed decisions and manage their trades effectively.

Pips and Forex Trading Strategies

Pips in Day Trading

Day trading is a popular strategy in Forex where traders buy and sell currencies within the same trading day. The goal is to capitalize on small price movements, often measured in pips, to make quick profits.

Role of Pips in Day Trading Strategies:

- Quick Profits: Day traders aim to capture small price movements, typically within a range of 10 to 50 pips per trade.

- High Frequency: Multiple trades are executed throughout the day, each targeting a specific number of pips.

- Risk Management: Due to the high frequency of trades, effective risk management is crucial. Setting stop-loss orders at specific pip levels helps limit potential losses.

Examples of Day Trading Strategies Focusing on Pips:

- Scalping: A strategy that involves making numerous trades to gain a few pips each time. Scalpers typically aim for 5 to 10 pips per trade.

- Breakout Trading: Traders look for key levels of support and resistance. When the price breaks through these levels, traders enter positions aiming to capture the ensuing pip movements.

Tips for Effective Pip Management in Day Trading:

- Set Realistic Targets: Define clear pip targets for each trade and stick to them.

- Use Tight Stop-Losses: Protect your capital by setting stop-loss orders close to your entry point.

- Monitor the Market: Stay alert to market conditions and be ready to adjust your strategy as needed.

Pips in Swing Trading

Swing trading involves holding positions for several days to weeks, aiming to profit from short to medium-term price movements. Pips play a vital role in measuring these price changes and determining potential profits.

Importance of Pips in Swing Trading:

- Larger Movements: Swing traders look for larger price movements, typically ranging from 50 to 200 pips or more.

- Trend Following: This strategy often involves following market trends, where significant pip movements can indicate the strength of the trend.

Examples of Swing Trading Strategies Utilizing Pips:

- Trend Trading: Identifying and following long-term trends. Traders enter positions when they expect the trend to continue and exit when the trend shows signs of reversing.

- Retracement Trading: Taking advantage of temporary price reversals within a larger trend. Traders look for retracement levels and enter positions to capture the pip movements during these reversals.

Managing Pips for Long-Term Success:

- Set Wider Stop-Losses: Since swing trades span a longer period, stop-loss orders should accommodate larger pip movements.

- Use Technical Indicators: Tools like Moving Averages, RSI, and Fibonacci retracements can help identify potential entry and exit points.

- Be Patient: Allow trades to develop over time, avoiding the temptation to close positions prematurely.

Common Mistakes and Misconceptions about Pips

Mistaking Pips for Points

One common mistake among beginner traders is confusing pips with points. While both measure price movements, they are not the same.

Clarifying the Difference between Pips and Points:

- Pips: The smallest unit of price movement in Forex trading. For most currency pairs, this is 0.0001. For pairs involving JPY, it is 0.01.

- Points: A broader term that can refer to any unit of price movement, not standardized like pips. In some contexts, points can mean the same as pips, but in others, it can refer to different magnitudes of price changes.

Examples to Illustrate the Difference:

- Forex Context: In EUR/USD, a move from 1.1000 to 1.1010 is a 10-pip movement.

- Stock Market Context: In stock trading, a point usually refers to a one-unit movement in the stock price, which can vary significantly in value.

Overlooking the Impact of Pip Spread

Another common misconception is overlooking the impact of the pip spread. The spread is the difference between the bid and ask price, and it plays a crucial role in trading costs.

Understanding Pip Spread and Its Impact on Trading:

- Definition: The pip spread represents the transaction cost imposed by brokers. A lower spread means lower costs and vice versa.

- Impact: High spreads can erode profits, especially for short-term traders who make frequent trades.

Examples of How Spreads Affect Trading Outcomes:

- Tight Spread Example: If the EUR/USD bid price is 1.1050 and the ask price is 1.1052, the spread is 2 pips. A trader needs the price to move by at least 2 pips in their favor to break even.

- Wide Spread Example: If the USD/ZAR bid price is 15.50 and the ask price is 15.60, the spread is 10 pips. The trader needs a 10-pip movement just to cover the spread.

Tips for Managing Pip Spreads Effectively:

- Choose a Broker with Low Spreads: Research and select brokers that offer competitive spreads.

- Trade Major Pairs: Major currency pairs typically have lower spreads compared to minor or exotic pairs.

- Monitor Market Conditions: Spreads can widen during volatile market conditions. Avoid trading during these times if possible.

FAQs about Pips in Forex Trading

What is a Pipette in Forex?

Definition and Explanation of Pipettes: A pipette is a fractional pip, representing a tenth of a pip. It provides an even more precise measurement of price movements.

Difference between Pips and Pipettes:

- Pips: The fourth decimal place in most currency pairs (e.g., 1.1050).

- Pipettes: The fifth decimal place in most currency pairs (e.g., 1.10505).

Examples of Pipette Usage:

- If EUR/USD moves from 1.10500 to 1.10510, it has moved 1 pip or 10 pipettes.

How Do Brokers Display Pips?

Different Ways Brokers Display Pips on Their Platforms:

- Standard Format: Most brokers display prices with four decimal places (e.g., 1.1050).

- Fractional Format: Some brokers display prices with five decimal places, including pipettes (e.g., 1.10505).

Understanding Pip Displays on Various Trading Platforms:

- MetaTrader 4: Typically displays four decimal places.

- MetaTrader 5: Can display five decimal places, including pipettes.

- cTrader: Provides options for both four and five decimal places.

Can Pips Be Negative?

Explanation of Negative Pips: Pips themselves are not inherently negative, but the movement of pips can result in a negative outcome if the price moves against a trader’s position.

Scenarios Where Pips Might Be Negative:

- Losing Trade: If a trader buys EUR/USD at 1.1050 and the price drops to 1.1030, the movement is -20 pips for the trader.

Impact of Negative Pips on Trading Decisions: Negative pip movements result in losses. It’s essential for traders to manage risk through stop-loss orders and proper position sizing to mitigate potential negative pip impacts.

Conclusion

Understanding what a pip is in Forex trading is fundamental for any trader. Pips are the building blocks of price movements and are crucial for calculating profits and losses. By mastering the concept of pips, traders can better analyze market trends, develop effective trading strategies, and manage risk.

This guide has covered the basics of pips, how they are calculated, their importance in trading, and common mistakes to avoid. By continuously learning and practicing, traders can enhance their skills and increase their chances of success in the Forex market.

Additional Resources

Recommended Forex Brokers for Beginners

- Exness: Open Account

- Pepperstone: Open Account

- OctaFx: Open Account

- Coinexx (US Residents): Open Account

Recommended Books and Courses

- Books:

- “Currency Trading for Dummies” by Brian Dolan

- “Forex for Beginners” by Anna Coulling

- Courses:

- Udemy’s “Forex Trading A-Z™ – With LIVE Examples of Forex Trading”

- Coursera’s “Financial Markets” by Yale University

Useful Websites and Tools

- Websites:

- BabyPips: Comprehensive Forex education and tools

- Investopedia: Detailed articles and tutorials on Forex trading

- Tools:

- Forex Pip Calculator: Online tool for calculating pip values

- TradingView: Advanced charting platform with numerous tools for traders